Q2 2020 Office Market Insight Report

Market Trends

1.) As most of the initial work from home growing pains have been resolved, many tenants, especially large corporate occupiers, have indicated that remote work will likely continue for the foreseeable future. COVID-19 sparked the largest work from home experiment in history and many companies have found that their employees are capable of being productive remotely. Though a completely remote work force is not an ideal situation for most companies, many feel it is a better option than rushing employees back into the office.

2.) Much like other cities across the country, downtown Minneapolis has experienced an increase in its sublease inventory. As social distancing continues to play a major role in slowing the spread of COVID-19, many people are avoiding the use of mass transit. In addition, large, multi-tenant office buildings with shared common areas, located in dense, urban cores have become less desirable. Both factors could contribute to an up-tick in the number of companies leaving their downtown digs for alternative options in the suburbs.

3.) With the school year quickly approaching, more and more schools are beginning to announce plans for continuation of online courses. This will directly impact the ability of employees with school-aged children to return to the office.

4.) Short term leases and extensions have become more common as occupiers continue to take a “wait and see” approach when analyzing their future real estate needs. Because of this, spec suites and subleases have become increasingly sought-after solutions.

5.) While some employees enjoy the flexibility that comes with working from home, it is certainly not a universal feeling. For many companies, video calls and makeshift home offices have been a short-term solution, not a viable long-term office replacement. The lack of face-to-face interactions and collaboration with co-workers can have a negative impact on productivity, mental health, and company culture.

6.) The “hub and spoke” office strategy is a concept that has continued to gain traction as of late. The “hub and spoke” model is defined as having a larger main office and strategically placed satellite offices spread throughout a specific geography. This concept offers employees flexibility, reduced commute times and lower parking costs.

7.) While it is not anticipated that many companies will abandon their office spaces all together, it is likely that a blend of in-office and remote work will increase in popularity. This hybrid solution not only offers flexibility for employees, but it can also help cut down on density in the workspace.

8.) Though transaction volumes have decreased, landlords remain optimistic that employers will begin phasing their employees back to the office shortly. As a result, rental rates have remained flat in Q2 2020.

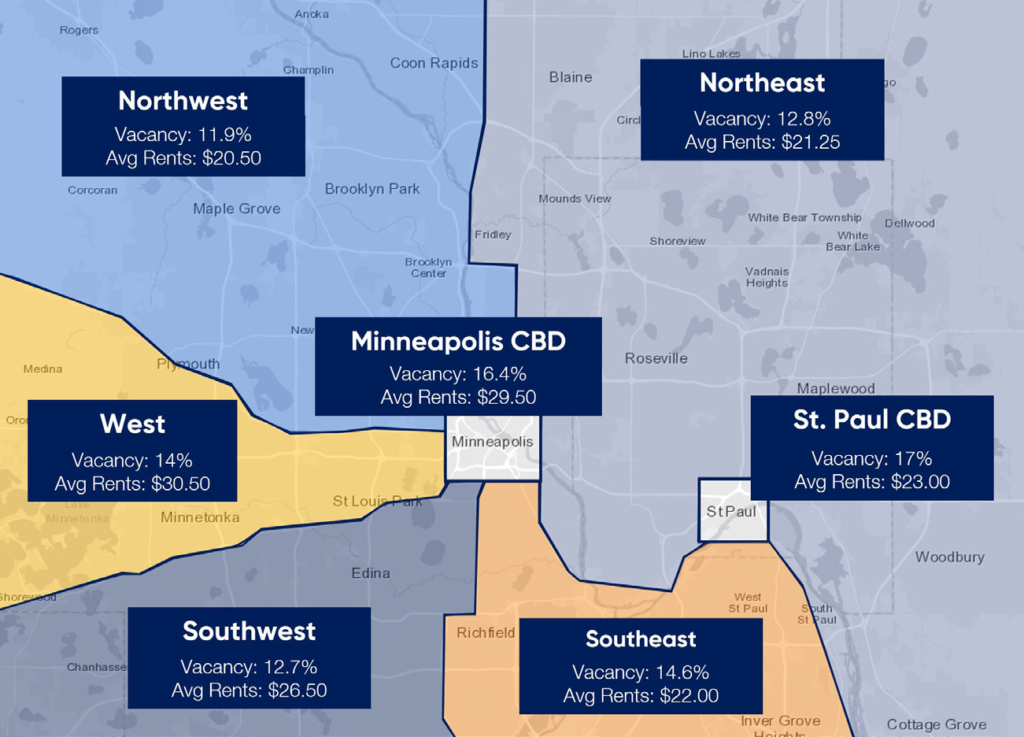

Rental and Vacancy Rates

(Click to enlarge)

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| Daikin | Atria Corporate Center | 45,000 SF | NW Metro | New Lease |

| Taft Stettinius & Hollister LLP | IDS Center | 150,000 SF | Minneapolis, CBD | Lease Renewal |

| Magenic | Towers at West End | 29,000 SF | West End | New Lease |

| Total Expert | Towers at West End | 28,000 SF | West End | New Lease |

| Vanco | Norman Pointe II | 33,000 SF | SW Metro, 494 Corridor | New Lease |

| Kewit | Norman Pointe I | 32,000 SF | SW Metro, 494 Corridor | New Lease |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

|---|---|---|---|---|

| Waitt Company | Bass Creek Business Center | 185,000 SF | NW Metro | $24.25 Million |

| University of Minnesota | University Park Plaza | 140,000 SF | Minneapolis, Midway | $20.7 Million |

| Persaud Properties | 7800 3rd Street N | 97,000 SF | NE Metro | $11.4 Million |

| United Health Group | 9699 Data Park Drive | 106,000 SF | SW Metro | $12.5 Million |

| AIC Ventures | 1313 Lone Oak Road | 109,500 SF | SE Metro | $11.8 Million |

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Office Market started the year off stable with an unemployment rate of 3.1% and projected GDP growth that was expected to continue to outperform the national economy. However, much like other cities of the world, the COVID-19 Pandemic has had a significant impact on the economy causing the unemployment rate to spike to 8.6% as of June 2020. The national average unemployment rate is currently 11.1%.