Q2 2021 Market Insight Report

Market Trends

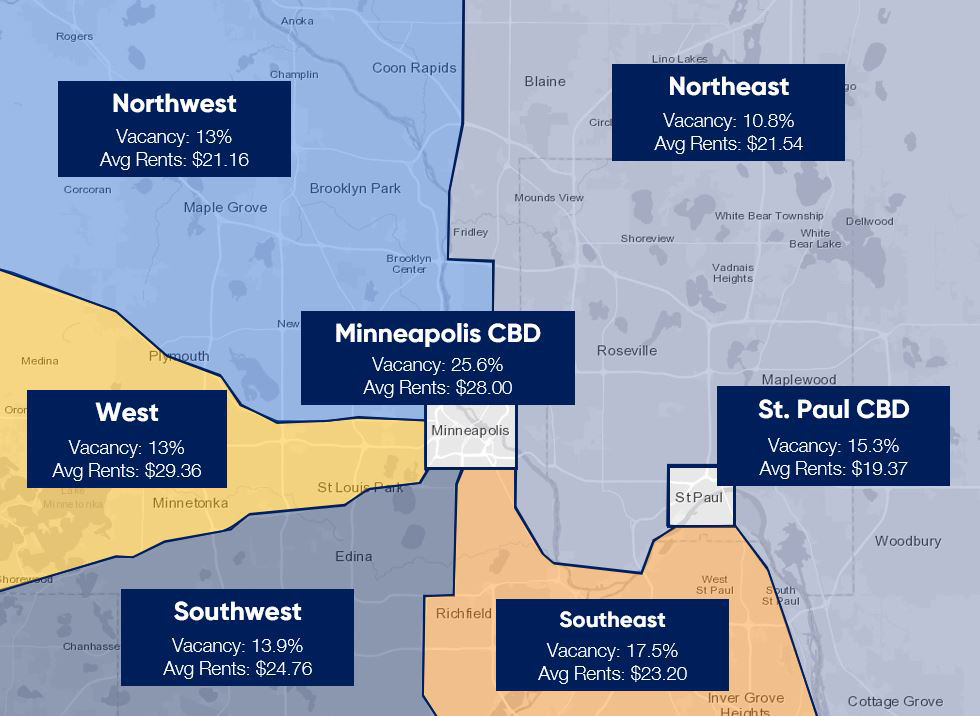

1.) Downtown Minneapolis’ office market has begun to gain some momentum as companies continue to bring their employees back to the office on a more regular basis. Many of Minneapolis’ large employers are using the first workday after Labor Day weekend (Sept. 7) as their unofficial return to office date, however, this date may change due to the Delta variant.

2.) While we expect to see an increase in the number of employees back in the office, most employers will likely adopt a hybrid approach going forward. Though every company is different, it is unlikely that many employers will revert to having all employees in the office full-time.

3.) The influx of sublease space being brought to market has tapered off with some companies even putting a pause on marketing efforts after realizing their office space will still be needed. Though new to market sublease opportunities have slowed, there is still a large inventory of sublease space throughout the Twin Cities.

4.) The 394-corridor, especially West End, has continued to be one of the most sought-after submarkets for occupiers. The centralized location, easy access and an abundance of area amenities has led to West End’s strong leasing activity.

5.) Flexibility remains a key area of emphasis among tenants making shorter-term leases increasingly important. As a result, subleases and spec suites are great short-term options offering fully furnished spaces and flexible terms for tenants looking to buy time as they evaluate their office space needs.

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| Schwans | Normandale Office Park | 83,300 SF | Southwest (494 Corridor) | New Lease |

| Bright Health | Normandale Office Park | 43,000 SF | Southwest (494 Corridor) | New Lease |

| Radisson Hospitality | 10 West End | 34,700 SF | Southwest (394 Corridor) | New Lease |

| Two Harbors | 10 West End | 34,640 SF | Southwest (394 Corridor) | New Lease |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

|---|---|---|---|---|

| Asana Partners | Colonial Warehouse | 203,000 SF | Minneapolis CBD | $35.4 Million |

| Apex Westwood, LLC | Westwood Office Park | 128,000 SF | Southwest (394) | $12 Million |

| The Holy Christian Church International | 3560 Delta Dental Drive | 65,000 SF | Southeast | $5 Million |

| Woodbury Leadership Academy | 8089 Globe Drive | 68,581 SF | Southeast | $11.4 Million |

| Monarch Alternative Capital /Crestlight Capital | 241 N 5th Ave, 411 Washington Ave, 500 N. 3rd Ave (Portfolio Sale) | 340,400 SF | Minneapolis CBD | $113 Million |

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Office Market consists of 130 million SF. As of February 2021, Minnesota’s unemployment rate had improved to 4%, outperforming the US unemployment rate of 5.8%.