Q2 2021 Industrial Market Insight Report

Market Trends

1.) As demand for industrial space remains strong across the state, there is an uptick of national development firms entering the Twin Cities market for the first time. One example of this is CRG’s new 1 million square foot development in Dayton.

2.) As available, buildable land in the first and second ring suburbs becomes increasingly sparce, developments are beginning to move further out. Cities like Lakeville, Elko New Market, Dayton, Rogers, Lino Lakes, and Centerville are all seeing an increase in development activity.

3.) Link Logistics (Blackstone) has grown its Twin Cities industrial portfolio significantly in the past few years and is now the largest landlord in the market. As other institutional investors continue to grow their presence in the Twin Cities, we expect to see climbing rental rates.

4.) Due to shortages and disruptions to the supply chain, building materials such as lumber and steel continue to be scarce. The lack of availability has led to a sharp increase in cost, which will likely continue for the foreseeable future.

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| Anagram | 5501 Old Shakopee Road | 172.650 SF | Southwest | New Lease |

| The Bernard Group | 3200 4th Ave E | 155,000 SF | Southwest | New Lease |

| King Solutions | 11020 Holly Lane | 156.200 SF | Northwest | New Lease |

| State of Minnesota | 13120 County Road 6 | 179,600 SF | North west | New Lease |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

| Link Logistics | Plymouth Ponds Business Park | 715,000 SF | Northwest | $82.3 Million |

| Investcorp/Onward | I-35 Industrial Center | 413,239 SF | Southeast | $17.2 Million |

| SOT A-F Owner/Eagle Ridge Partners | Shady Oak Business Center | 304,073 SF | Southwest | $19 Million |

| Link Logistics | Prologis Portfolio | 2,534,814 SF | Various | $246.5 Million |

| Eagle Ridge Partners | Link Tech Portfolio | 404,457 SF | Various | $34 Million |

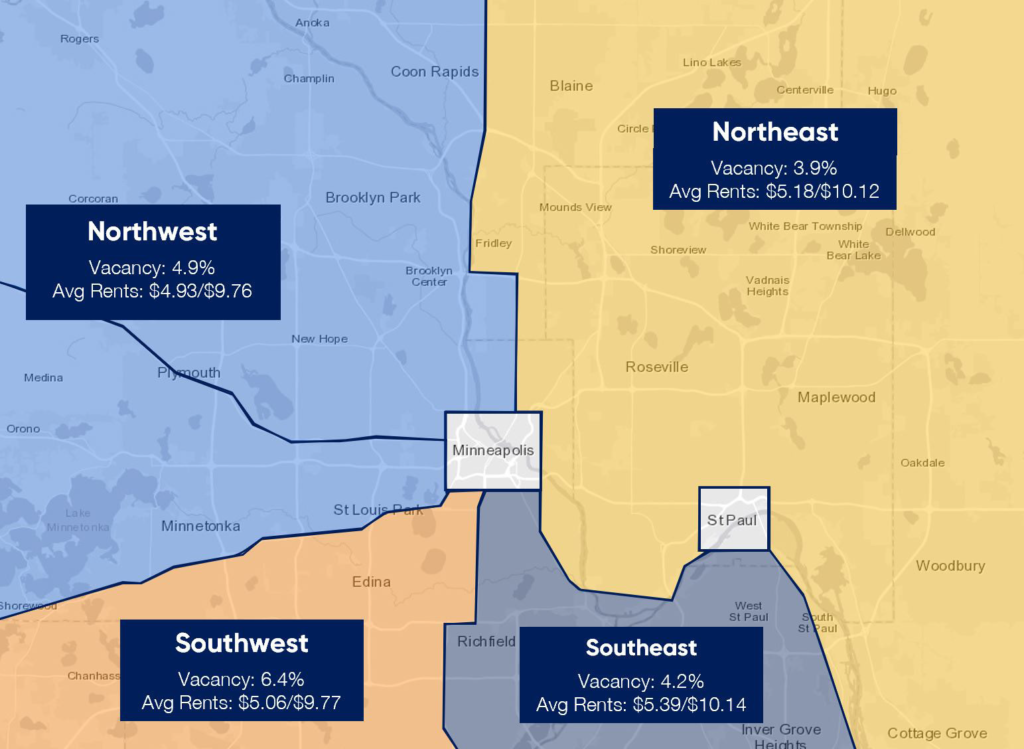

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Industrial Market consists of over 264 million SF. As of May 2021, Minnesota’s unemployment rate had improved to 4%, outperforming the US unemployment rate of 5.8%.