Q2 2020 Industrial Market Insight Report

Market Trends

1.) The industrial sector is better positioned to weather the economic complications caused by COVID-19 than any other areas of the economy. This in large part has to do with the rapid growth of e-commerce.

2.) The demand for immediate goods was magnified because of COVID-19. To ensure quick delivery times and fulfill last minute needs, there will likely continues to be an increased demand for industrial space in and near urban areas.

3.) Much like the office sector, there has been an increased emphasis on cleanliness, social distancing, and staggered shifts for warehouse employees. It is expected that more industrial properties will seek WELL certification, which is a designation awarded to buildings that meet a set of requirements promoting employee health, safety, and wellness.

4.) There has been a continued demand for warehouse and cold storage space as companies look to bulk up their inventory in order to increase efficiency.

5.) Rental rates have remained fairly flat during Q2 2020, but are expected to slightly increase, as demand for industrial space remains strong and vacancy rates continue to trend downward.

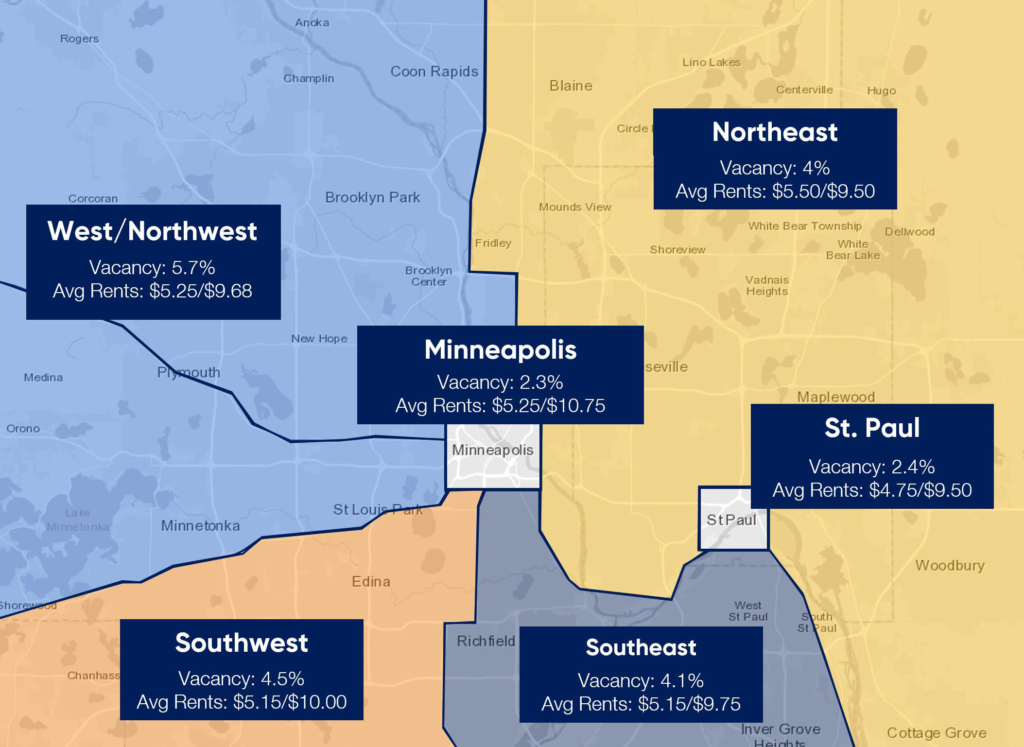

Rental and Vacancy Rates

(Click to enlarge)

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| NuAire, Inc | 2100 Fernbrook Lane | 170,000 SF | Northwest Metro | New Lease |

| Kurita America | 6500 93rd Ave North | 155,000 SF | Northwest Metro | New Lease |

| Simpson Strong-Tie | InverPoint Business Center | 80,000 SF | Northease Metro | New Lease |

| Sweet Harvest Foods | Launch Park | 100,000 SF | Southeast Metro | New Lease |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

|---|---|---|---|---|

| Cabot Properties | 11011 Holly Lane North | 283,778 SF | NW Metro | $27.75 Million |

| Persaud | Oaks Tech Center IV | 98,000 SF | NE Metro | $11.4 Million |

| MetLife Investment Management | Amazon Fulfillment Center | 860,000 SF | SW Metro | $118 Million |

| Undisclosed | Mid-City Logistics Hub | 400,000 SF | Minneapolis (Northeast) | $17.4 Million |

| Global Glove & Manufacturing | 13601 Tungsten Street NW | 61,654 SF | NW Metro | $2.5 Million |

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Office Market started 2020 off

stable with an unemployment rate of 3.1% and projected GDP growth that was expected to continue to outperform the national economy. However, much like other cities of the world, the COVID-19 pandemic has had a significant impact on the economy causing the unemployment rate to spike to 8.6 % as of June 2020. The national average unemployment rate is currently 11.1%.