Q1 2020 Office Market Insight Report

Market Trends

1.) Much like in other cities across the globe, COVID-19 has created uncertainty in the Twin Cities office market. “stay-at-home” orders have left a majority of the Twin Cities’ office inventory vacant for the time being. Due to the inability to utilize leased space, many companies have turned to legal counsel in an attempt to achieve rent relief through contractual provisions and clauses set forth in their leases. Some landlords have been more receptive than others and have been willing to offer creative solutions to provide relief for their tenants during this unprecedented time.

2.) The COVID-19 outbreak has forced employers around the world to quickly implement work from home policies. This is the most widespread remote work study in history and the results will vary drastically from company to company. Though work from home policies could certainly result in cost savings to an organization’s bottom line, it can also have a negative impact on company culture and ease of collaboration. We anticipate that the implementation of permanent work from home arrangements will be done on a case by case basis going forward and while it is likely that companies may decrease their real estate footprints, we do not anticipate an overwhelming migration from office buildings to home offices when the dust settles.

3.) Increasing efficiency has been a major office trend over the past few years. Many companies have turned to smaller workstations and open floor plans in order to increase density while simultaneously decreasing their footprint. However, COVID-19 has caused tenants to question this concept, as close quarters can result in an increased spread of illness.Post COVID-19 office environments will likely offer employees more elbow room, implement enhanced cleaning protocols, and feature more advanced air filtration/HVAC systems, to name a few. If tenants do not have the ability to increase the radius around each employee’s workstation, companies may take a phased approach and have designated groups of employees coming into the office on different days of the week, in order to decrease density.

4.) Co-working providers have certainly felt the negative impacts of the COVID-19 outbreak but could potentially benefit in the long run. As many companies will look to bulk up their continuity plans going forward, co-working options will play a key role in enabling companies to execute flexible work strategies.

5.) Speculative office suites have continued to gain traction across the Twin Cities. Spec suites come fully built out and furnished, providing tenants with a true turnkey option. As agility, flexibility, and efficiency remain top priorities for occupiers, we expect to see the Twin Cities’ spec suite inventory continue to increase in the coming years.

6.) The Twin Cities will likely see a surge in sublease availability as companies will look to offload excess space to cut down on costs. Subleases will also be more attractive to tenants looking for flexible lease terms. Having said that, it is now more important than ever that subtenant’s thoroughly review the financials of the sublandlord before committing to a sublease.

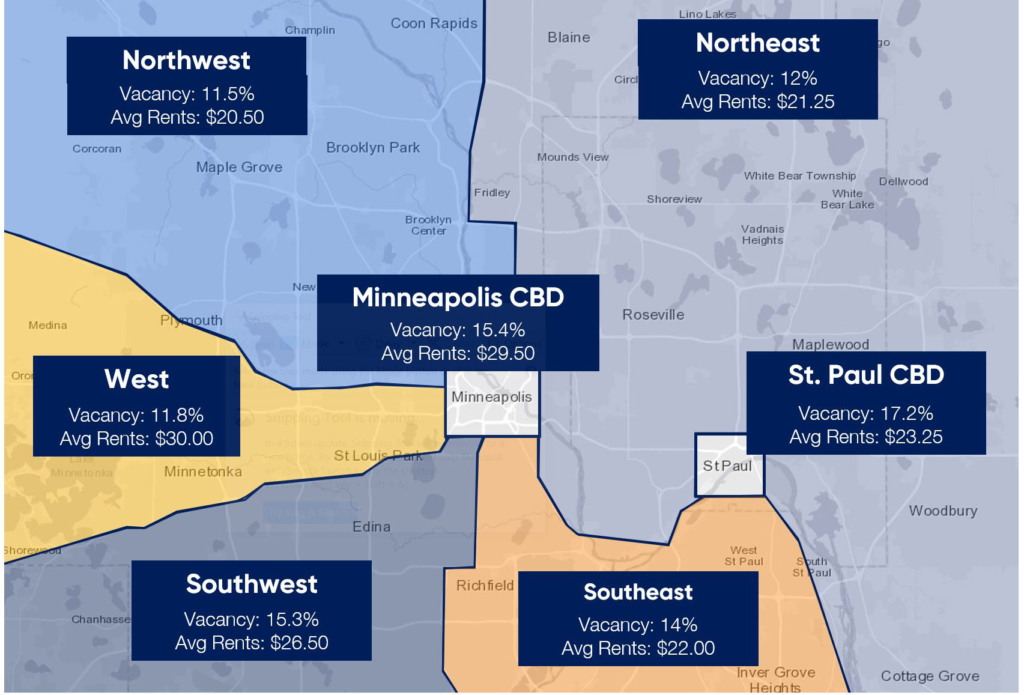

Rental and Vacancy Rates

(click to enlarge)

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| CarVal | 10 West End | 35,000 SF | 394 Corridor | New Lease |

| West Monroe Partners | The Nordic | 42,000 SF | Minneapolis, North Loop | New Lease |

| LifeTime Work | 30 Ninth St. | 53,000 SF | Minneapolis, CBD | New Lease |

| The Nerdery | 7700 France Building | 64,000 SF | SW Metro, 494 Corridor | New Lease |

| Microsoft | 3601 76th St. W | 44,000 SF | SW Metro, 494 Corridor | Lease Renewal |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

|---|---|---|---|---|

| Cargill, Inc. | Cargill HQ | 488,000 SF | Southwest Metro | $75 Million |

| Waitt Co. | 6150 Trenton | 178,000 SF | Northwest Metro | $24.25 Million |

| Dominium | Crest Ridge | 120,000 SF | 394 Corridor | $18.5 Million |

| Bridge Investment Group | West End Office Park | 568,000 SF | 394 Corridor, West End | $131 Million |

| DGB Investors | Designers Guild Buildings | 102,000 SF | Minneapolis, North Loop | $20 Million |

| Syndicated Equities | 4400 Baker Rd & 4350 Baker Rd | 78,905 SF | SW Metro | $40 Million |

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Market started the year off stable with an unemployment rate of 3.1% and projected GDP growth that was expected to continue to outperform the national economy. However, the COVID-19 pandemic has had a significant impact on the U.S. economy, which could lead to the highest nationwide unemployment levels since the great depression and the largest GDP decline in US history. A recent report written by The Economic Policy Institute estimates that Minnesota’s unemployment rate could spike as high as 15% by July 2020.