Q4 2020 Office Market Insight Report

Market Trends

1.) A majority of Minnesota’s office users have continued to hold off on bringing employees back to the office full time. Work from home protocols are expected to remain in place until the vaccine is available to the masses. We do not anticipate a drastic change in this trend until summer of 2021.

2.) Short term lease extensions continue to be the temporary solution of choice for many companies looking to buy time, as they continue to evaluate their long-term real estate plans.

3.) The Twin Cities’ sublease inventory rose significantly during Q2 and that trend continued throughout Q3. However, this number began to level off in Q4. As more research is being conducted regarding employees work preferences, new studies are being published suggesting that for many office workers, the allure of working from home is beginning to wear off and employees are ready to return to the office in some compacity.

4.) As companies begin to bring their employees back to the office, we anticipate the work environment will be modified to offer much more flexibility. Many believe that offices will be used as more of a collaboration space going forward giving employees the choice to work how/where they see fit. It is expected that more and more companies will abandon dedicated office spaces in exchange for more touchdown/flexible workspace.

5.) Though the need for office space varies from company to company, it’s hard to argue the fact that having employees together and collaborating helps create a sense of culture and encourages innovation. Companies have been able to get by with remote working, however, for many, this is not the preference. We anticipate office space to continue playing a significant role in attracting and retaining top talent post pandemic.

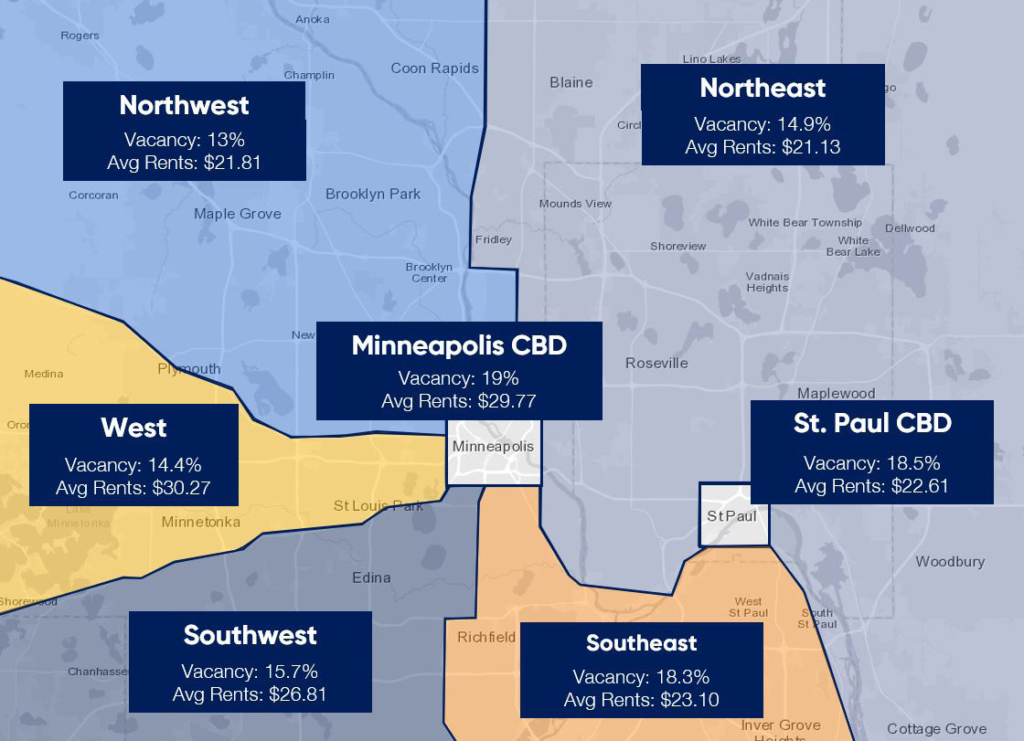

Rental and Vacancy Rates

(Click to enlarge)

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| Fredrickson & Byron | RBC Plaza | 178,191 SF | Minneapolis, CBD | New Lease |

| AVI Systems | 9675 W 76th St | 46,648 SF | Southwest Metro | Lease Renewal |

| SPS Commerce | SPS Tower | 118,039 SF | Minneapolis, CBD | Lease Renewal |

| One 10 Marketing | Butler Square | 30,533 SF | Minneapolis, CBD | Lease Renewal |

| Hanson Efron | Capella Tower | 18,000 SF | Minneapolis, CBD | New Lease |

| Deluxe Corporation | 121 S 8th Street | 23,207 SF | Minneapolis, CBD | New Lease |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

|---|---|---|---|---|

| Eagle Ridge Partners/Long Wharf Capital | One Southwest Crossing | 233,000 SF | Southwest Metro | $16.5 Million |

| Davis | Cornerstone Medical Building | 53,000 SF | Northeast Metro | $25 Million |

| Northpark CC LLC | Northpark Corporate Center | 146,000 SF | Northeast Metro | $12.2 Million |

| Juniper City Center Plymouth LLC | 15700 37th Ave N | 50,000 SF | Northwest Metro | $15.5 Million |

| 3960 Coon Rapids LLC | Mercy Healthcare Center | 76,000 SF | Northeast Metro | $16.6 Million |

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Office Market started the year off stable with an unemployment rate of 3.1% and projected GDP growth that was expected to continue to outperform the national economy. Minnesota’s job market has improved significantly over the past two quarters as the nation continues to recover from the negative impacts brought on by COVID-19. In November of 2020 Minnesota’s unemployment rate had improved to 4.4%, roughly 2 percentage points below the national average of 6.7%.