Q4 2020 Industrial Market Insight Report

Market Trends

1.)The industrial sector finished 2019 strong with 3.8 million square feet of absorption and that momentum carried into Q1 2020. While COVID-19 has had a negative impact on all product types, demand for warehousing, manufacturing, and e-commerce have remained strong, making the industrial sector best positioned to weather the storm. With 2.4 million square feet already under construction in Q1 2020, we expect to see developers remain bullish throughout the year.

2.) Institutional investors continue to shift their focus to secondary markets as primary markets have become increasingly competitive. Multinational private equity investor, Blackstone, has significantly increased its presence in the Twin Cities with the recent acquisition of CSM Corporation’s 5.7 million square foot industrial portfolio and Industrial Equities’ 2.5 million square foot portfolio, bringing Blackstone’s Twin Cities industrial portfolio to 13 million SF. This makes Blackstone the largest owner of industrial real estate in the Twin Cities by a large margin. Prologis also recently re-entered the market. Both companies will certainly have an influence on asking rates in the Twin Cities going forward.

3.) The food industry has been disrupted as a result of COVID-19. An increase in online orders has overwhelmed supply chains and increased the need for warehouse space, cold storage, and distribution centers across the globe. Though the significant spike in demand may be temporary, consumer’s altered purchasing habits may outlive the virus, creating a need for companies to continue bulking up their e-commerce/warehousing capabilities going forward.

4.) Much like the automation robotics made famous by Amazon’s fulfillment centers, the COVID-19 outbreak could accelerate the implementation of similar technology from other companies in an attempt to increase efficiency and limit reliance on the labor market. This shift would likely have direct impact on building design as it would require less on-site parking and would enable racking to be stacked higher, resulting in taller buildings with smaller overall footprints. Proximity to labor pools would also be a less important factor to consider during the site selection process.

Market Movement

| Tenant | Building | Size | Submarket | Type |

|---|---|---|---|---|

| Aveda Corporation | Lexington Preserve I | 187,000 SF | NE Metro | Lease Renewal |

| Ableconn | 8550 Zachary Ln | 110,000 SF | NW Metro | New Lease |

| Cirtec Medical | Capstone Business Center | 69,072 SF | NW Metro | New Lease |

| The ADS Group | Berkshire Lane I & II | 52,000 SF | NW Metro | Lease Renewal/Expansion |

| Design Ready Controls | Capstone Business Center | 28,449 SF | NW Metro | Lease Expansion |

| Restwell Mattress | 9901 W 74th St | 47,548 SF | SW Metro | Lease Renewal |

Investment Sales

| Buyer | Building | Size | Submarket | Price |

|---|---|---|---|---|

| Blackstone (Link) | CSM Portfolio Sale (55 Properties) | 7 Million SF | Metro Wide | $665 Million |

| Capital Partners | Scannell Properties Portfolio Sale | 558,000 SF | Newport, Brooklyn Park, Bloomington, Maple Grove, Shakopee | $60 Million |

| Americold Realty Trust | 2233 Maxwell Ave (Cold Storage) | 217,326 SF | East Metro | $56 Million |

| Heitman Capital Management | Midway Stadium Business Center | 189,746 SF | Midway | $23.8 Million |

| Viking Partners | 9401 James Ave | 115,043 SF | SW Metro | $9.6 Million |

| Blackstone (Link) | Beacon Bluff Business | 87,038 SF | NE Metro | $10.25 Million |

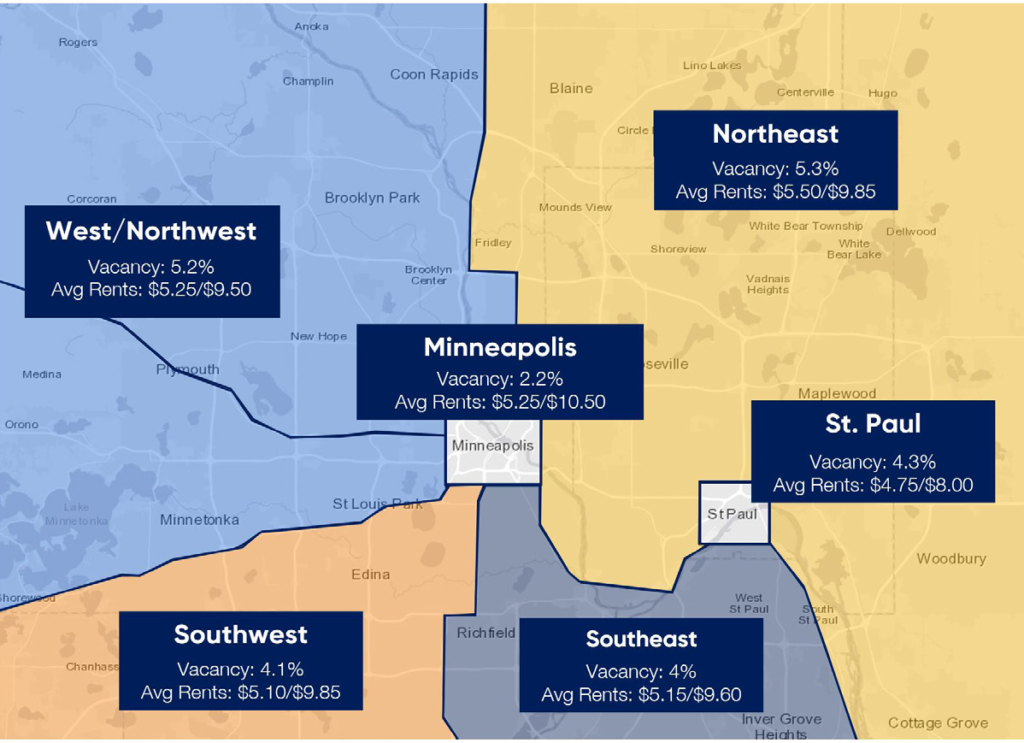

Minneapolis/St. Paul, collectively referred to as the Twin Cities, is the 16th largest MSA with approximately 3.6 million residents and home to 17 fortune 500 public companies’ headquarters. The Twin Cities is also ranked highly for quality of life, labor force participation, health care, and workforce quality. The Minneapolis/St. Paul Market started the year off stable with an unemployment rate of 3.1% and projected GDP growth that was expected to continue to outperform the national economy. However, the COVID-19 pandemic has had a significant impact on the U.S. economy, which could lead to the highest nationwide unemployment levels since the great depression and the largest GDP decline in US history. A recent report written by The Economic Policy Institute estimates that Minnesota’s unemployment rate could spike as

high as 15% by July 2020.